Morgan Stanley’s recent expansion into the crypto space has reignited discussions around its Bitcoin Price Prediction: Morgan Stanley’s Big Move Puts $120K in Sight. The step signals growing institutional confidence in digital assets and suggests that Bitcoin may be on track for a new record high. This article explores the key drivers behind the $120K outlook, the technical picture, potential risks, and what investors should watch closely.

Morgan Stanley’s Bold Entry Into Crypto

The Wall Street giant has revealed plans to roll out crypto trading for E*Trade customers in collaboration with Zerohash. This initiative will provide investors direct access to Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) within a trusted brokerage environment.

More than just a technological update, this move marks a turning point for mainstream adoption, making it easier for traditional investors to step into the crypto market. As a result, many analysts see Bitcoin Price Prediction: Morgan Stanley’s Big Move Puts $120K in Sight as increasingly realistic rather than speculative.

Key Factors Supporting the $120K Target

Strong Institutional Inflows

ETFs remain a major catalyst. BlackRock’s Bitcoin and Ether funds alone are producing hundreds of millions in annualized revenue, showing continued institutional appetite. These inflows add consistent buying pressure, reinforcing long-term bullish momentum.

Policy Shifts and Regulatory Progress

In the U.S., lawmakers are considering measures like a crypto “innovation exemption” that would lower compliance hurdles for issuers and exchanges. Such reforms could further validate crypto as a mainstream financial instrument and make Morgan Stanley’s $120K projection more credible.

Favorable Macro Conditions

Bitcoin’s price trends often mirror global liquidity cycles. With central banks signaling lower rates and maintaining supportive policies, risk assets are likely to benefit. For many investors, Bitcoin is becoming a hedge against inflation and market uncertainty.

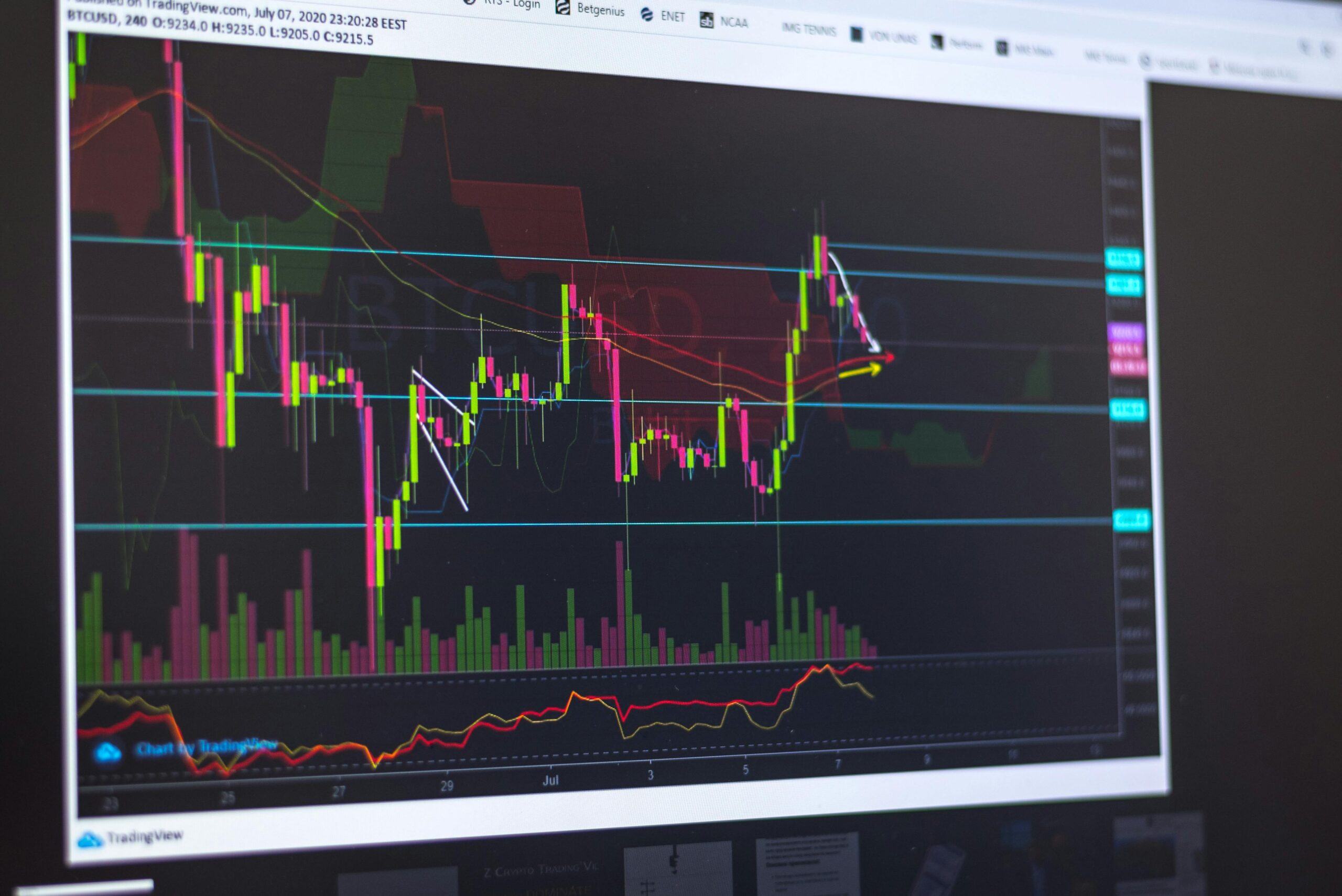

Technical Outlook: Path Toward $120K

At present, Bitcoin trades near $112,000, hovering just under the critical 50-day and 200-day EMAs. This area has acted as a base of support, hinting at potential dip-buying opportunities.

A decisive break above the $113,450–$114,750 resistance range could trigger a push to $116,150 and eventually $118,000. Clearing those levels would strengthen the case for Bitcoin Price Prediction: Morgan Stanley’s Big Move Puts $120K in Sight.

However, if BTC slips below $112,000, downside levels at $110,850 and $108,750 could come into play, reminding traders that volatility is always part of the landscape.

Risks That Could Delay or Reverse the Rally

Despite strong signals, challenges remain:

- Regulatory uncertainty – Sudden crackdowns or unfavorable rulings could weaken momentum.

- Institutional flows – If ETF demand slows, upward pressure may ease.

- Market sentiment – Overleveraged positions or global market shocks could spark sharp corrections.

Why Investors Should Pay Attention

The growing discussion around Bitcoin Price Prediction: Morgan Stanley’s Big Move Puts $120K in Sight highlights more than hype. It reflects a maturing ecosystem where infrastructure, institutional adoption, and regulatory clarity converge.

For investors, this represents a critical decision point: enter early and ride the potential rally to $120K, or wait for stronger confirmation and risk missing significant upside.

Conclusion

Morgan Stanley’s deeper involvement in crypto adds weight to the case that Bitcoin Price Prediction: Morgan Stanley’s Big Move Puts $120K in Sight is achievable. Institutional adoption, policy shifts, and strong technical setups create favorable conditions for Bitcoin’s next surge.