Bitcoin (BTC) has surged past the $104,000 mark, trading around $104,341. This comes as bullish momentum builds and trading volume reaches nearly $40 billion. With more than 19.88 million BTC already mined, supply remains tight — reinforcing the upward trend.

Recent developments in U.S. legislation and crypto infrastructure are also contributing to market excitement, positioning Bitcoin for potential further gains in the short term.

Ohio Passes Pro-Crypto Bill Offering Tax Relief and Miner Protections

In a significant move for digital currency regulation, the Ohio House of Representatives has passed House Bill 116, also known as the Blockchain Basics Act. Key highlights of the bill include:

- A $200 capital gains tax exemption for crypto transactions

- Protection for users’ rights to hold their own crypto wallets (self-custody)

- Safeguards for miners against restrictive zoning laws

The bill is now under review by the Ohio Senate. If passed, this legislation would make Ohio the first U.S. state to offer such comprehensive crypto-friendly legal protections. Analysts see it as a step toward broader nationwide crypto acceptance.

Kraken Partners With Babylon Labs to Launch Native Bitcoin Staking

Crypto exchange Kraken has teamed up with Babylon Labs to introduce native Bitcoin staking. This means users can now stake their BTC directly—without converting it to wrapped tokens, using bridges, or relying on third-party lenders.

Staked assets remain on the Bitcoin network, and users are rewarded with BABY tokens. This innovation allows Bitcoin to participate in decentralized finance (DeFi) while reducing available supply, potentially creating more price support.

The staking process remains trustless and transparent, offering a new layer of utility to Bitcoin and appealing to both long-term holders and yield-seeking investors.

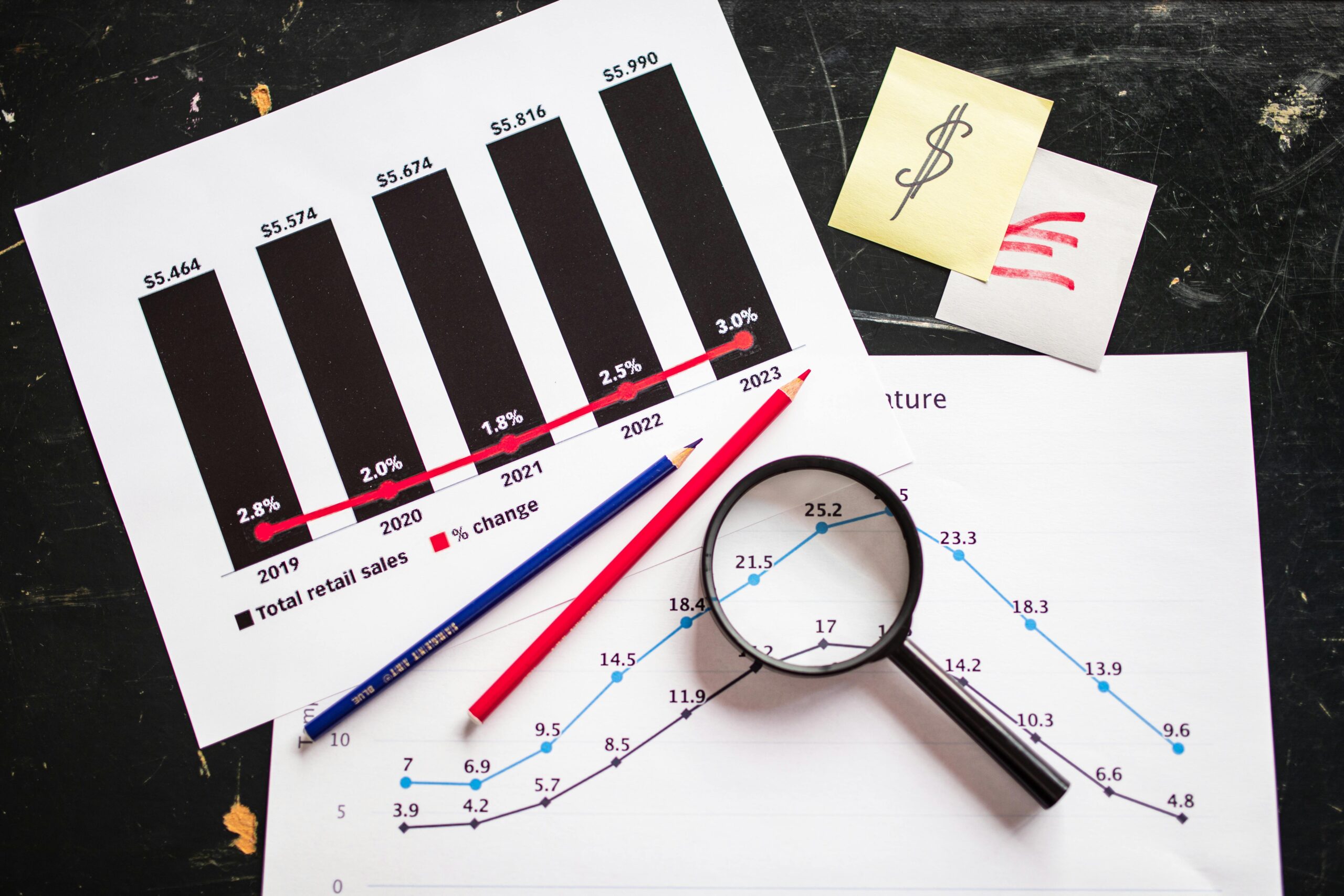

Bitcoin Technical Analysis: Ready for a Breakout?

Bitcoin’s price chart shows the formation of an ascending triangle on the 2-hour timeframe, indicating a possible breakout. The price is currently pressing against resistance around $105,000, while the 50-hour exponential moving average offers strong support near $105,252.

Analysts are watching closely for a breakout above $105,500. If that happens, potential upside targets include $107,200 and $108,351. Traders may consider setting stop-losses just below the $103,400 trendline to manage risk.

Market indicators like the MACD are relatively flat, suggesting a buildup before a possible momentum shift. Candlestick patterns are also hinting at a potential move upward.

BTC Bull Token Gains Momentum as Presale Nears Its Cap

With Bitcoin climbing, the BTC Bull Token has gained investor attention. The token’s presale has already raised over $7.25 million toward its $8.29 million hard cap. It’s currently priced at $0.00257, with prices expected to rise once the cap is reached.

This token offers more than just speculative value. Its smart design includes airdrops and automatic burns every time Bitcoin’s price increases by $50,000. Additionally, the project offers a staking pool with 58% annual returns, full liquidity, and no fees.

As the presale nears completion, interest in the token continues to grow, especially among investors looking to benefit from both Bitcoin’s price action and passive income strategies.

Conclusion

Bitcoin’s push toward and beyond $104K reflects both strong market fundamentals and encouraging developments in regulation and innovation. With Ohio leading the way on crypto-friendly policy and native Bitcoin staking now available through Kraken and Babylon Labs, BTC is positioned for continued growth. If Bitcoin breaks past $105,500, the stage may be set for the next major rally in 2025.